Australia's new merger control regime - An update

A new mandatory merger control regime will operate in Australia from 1 January 2026, governed under the Competition and Consumer Act 2010 (Cth) and administered by the Australian Competition and Consumer Commission (ACCC). The regime represents a significant departure from the current system and a substantial expansion in the scope of transactions that will be subject to competition review.

Businesses will be required to notify the ACCC acquisitions and mergers that meet prescribed monetary or market thresholds, and must not put notifiable transactions into effect until they are approved by the ACCC. In addition to business (share or asset) acquisitions, certain acquisitions of real property will fall within the scope of the regime – subject to the limited proposed exceptions mentioned below.

Due to the objective financial thresholds, notification will be mandatory for many transactions for which competition issues would not have been on the radar for businesses and their advisers under the existing regime, where notification is not mandatory and the ACCC’s role is one of monitoring and seeking judicial enforcement, rather than administration.

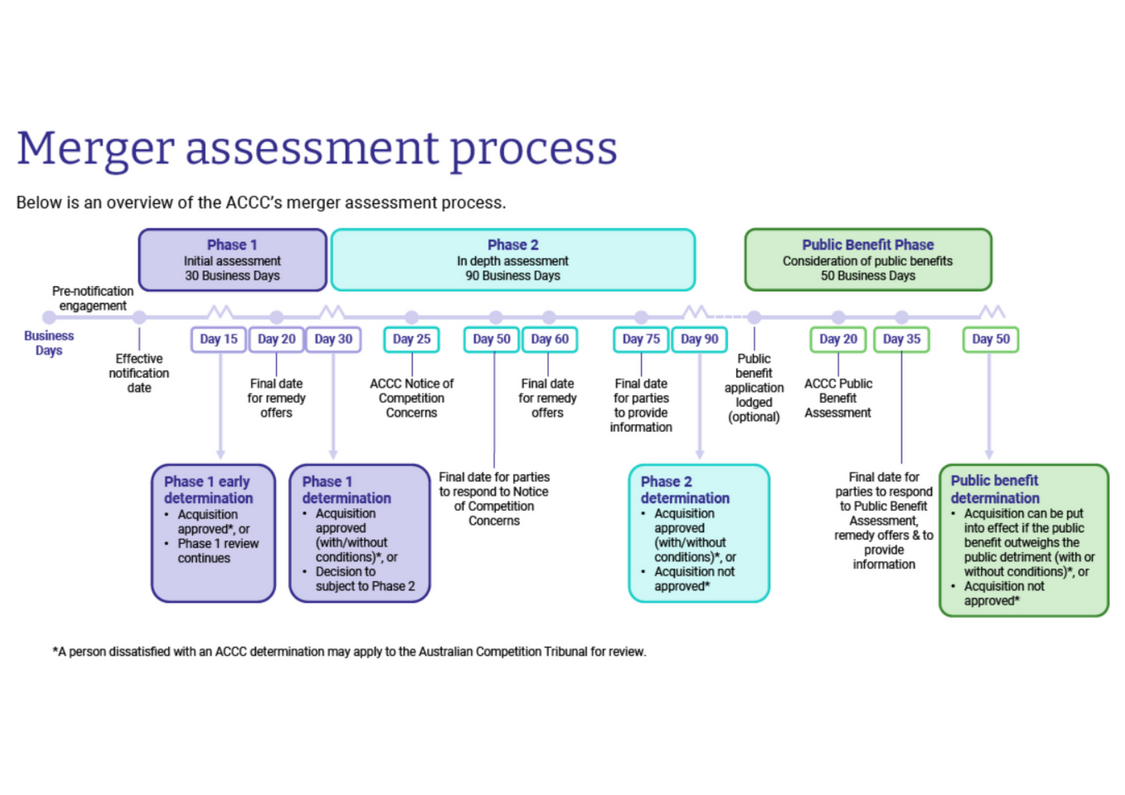

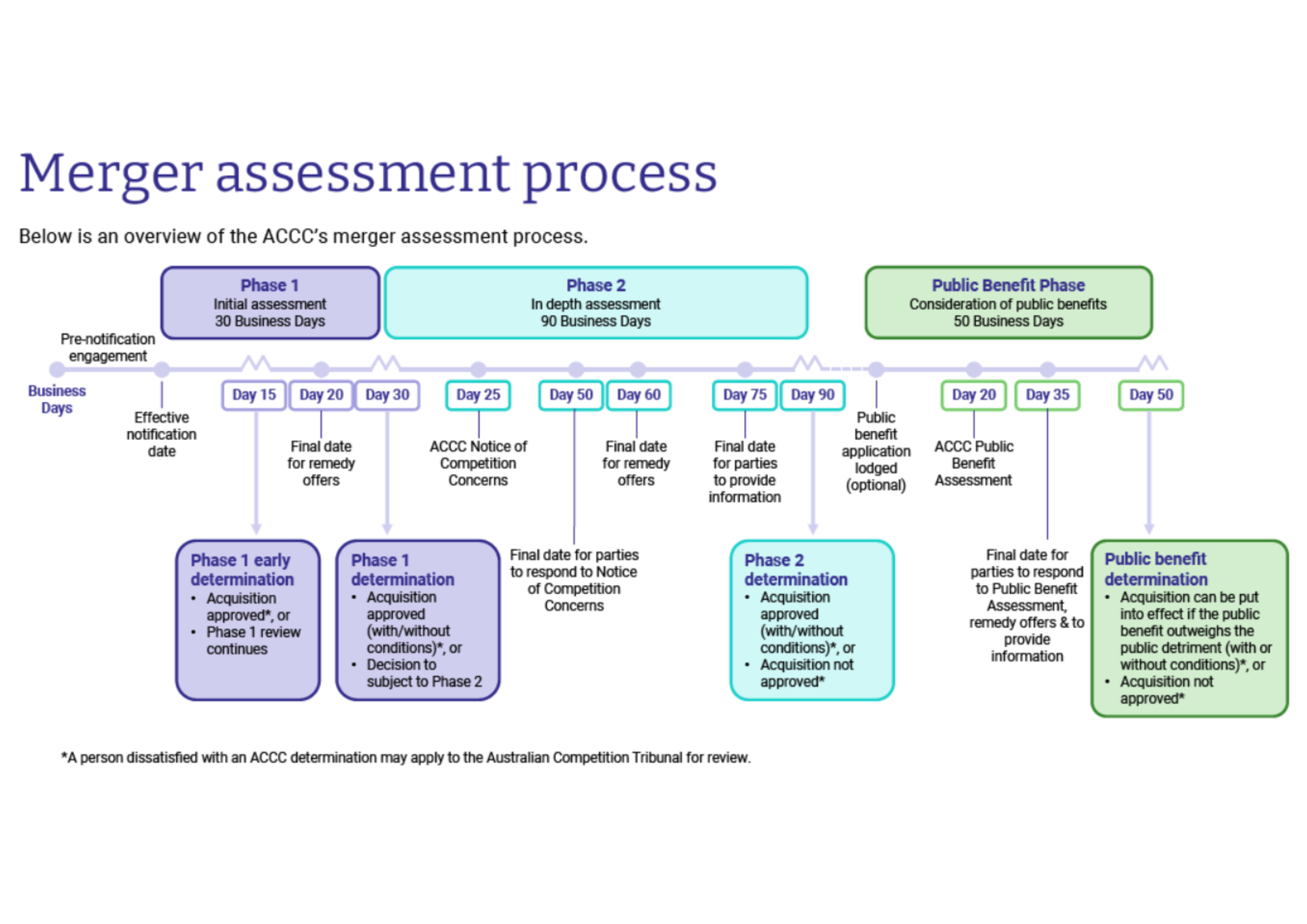

As a result, parties must begin factoring in statutory assessment timeframes to transaction timetables (a minimum of 15 business days, but can extend up to 215 business days or longer where competition and public benefit issue arise, remedies are proposed and extensions are triggered) - plus a 14-day waiting period before the transaction can be completed. The ACCC has indicated it expects 80% of transactions will be approved within 15 to 20 business days following notification – or via the pre-notification waiver process.

The ACCC’s role remains to prevent mergers that are likely to substantially lessen competition. While the legislation provides some additional clarification around that test, the intent is not to alter its substance. Notably, the ACCC retains powers to investigate and seek to block transactions even if they fall outside the notification thresholds, where they may still substantially lessen competition.

Treasury has recently released an exposure draft instrument, and the ACCC has released draft guidance – both of which will be critical to understanding and managing the new regime in practice. Below we comment briefly on:

- Treasury’s draft determination on notification thresholds, exemptions, and information requirements

- The ACCC’s draft merger assessment guidelines

- The ACCC’s draft merger process guidelines

- The ACCC’s guidance on transitional arrangements

Proposed merger control notification thresholds

Treasury has published an exposure draft of the Competition and Consumer (Notification of Acquisitions) Determination 2025. This outlines the proposed thresholds and procedures for the new mandatory regime, which will be available on a voluntary basis from 1 July 2025 and become mandatory from 1 January 2026.

Mandatory notification to the ACCC will be required where the following thresholds are met:

- Large businesses: Where the combined GST turnover of the acquirer and target is at least $200 million, and either:

- the target has a turnover of at least $50 million; or

- the transaction value, based on either market value or total consideration paid, is at least $250 million.

- Very large corporate groups: Acquisitions by entities with GST turnover of $500 million or more, targeting businesses with a turnover of $10 million or more.

- Creeping or serial acquisitions:

Acquisitions made by the same entity (or connected entities) within a three-year period that collectively exceed:

- $50 million; or

- $10 million where made by a very large corporate group.

- Major supermarkets: Acquisitions by Coles or Woolworths involving supermarket businesses or certain land acquisitions – regardless of size.

The creeping acquisition test may result in mandatory notification of transactions that are individually immaterial but cumulatively significant – posing a new compliance burden for serial acquirers.

Treasury sought stakeholder input on several provisions within the draft, including:

- Combined turnover test: Use of current GST turnover as a metric

- Cumulative acquisitions: Clarity and appropriateness of the aggregation rules

- Transaction value test: Market valuation methodologies

- Supermarket-specific rules: Competitive impacts and fairness

- Exemptions: Including for:

- acquisitions for residential property development

- acquisitions of commercial property for development

- real property lease renewals and extensions

- acquisitions by insolvency practitioners

- acquisitions arising from death or survivorship

The draft also prescribes short-form and long-form notification templates, both of which require substantial supporting information, even at the short-form level. As such, notification preparation will become a material component of transaction planning.

Draft merger assessment guidelines

The ACCC’s draft merger assessment guidelines, released on 20 March 2025, are intended to replace its November 2008 merger guidelines, updating both the framing and the economic analysis underpinning the ACCC’s approach.

The draft guidelines reflect and clarify the ACCC’s approach as described existing form of merger guidelines, with changes to emphasis in certain areas. Key changes include:

- stronger focus on the potential for the “creation, strengthening or entrenchment” of market power to give rise to a substantial lessening of competition, which may have application in the context of serial acquisitions (amongst other areas);

- greater emphasis on sophisticated economic analysis.

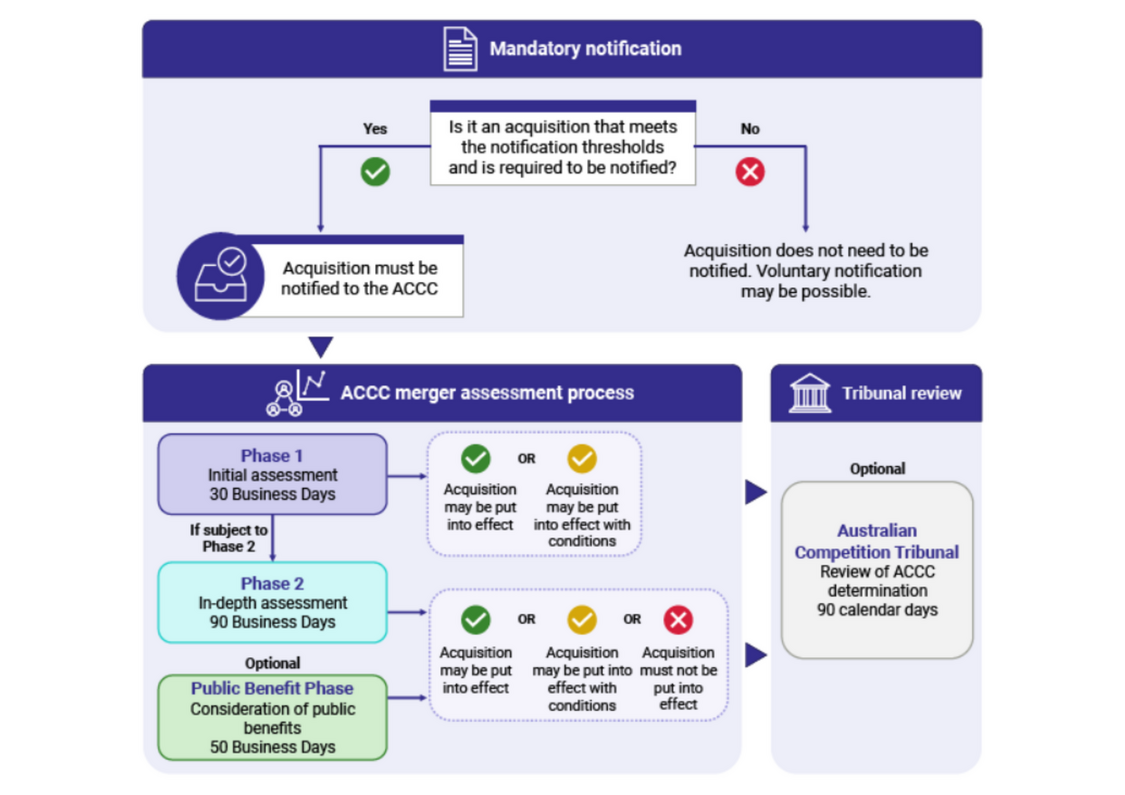

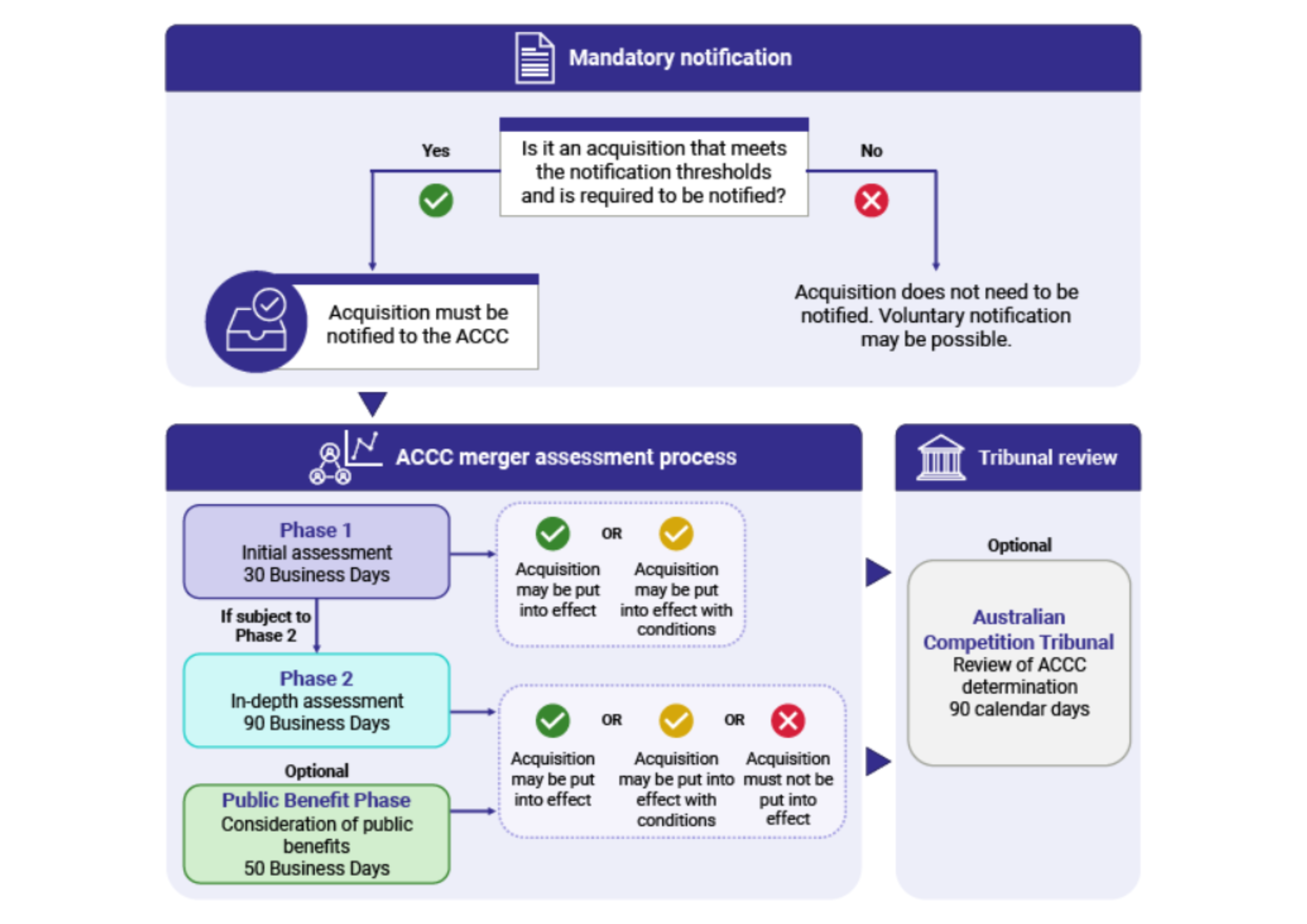

Image from ACCC "Merger process: Quick guide for businesses - What you need to know" 27 March 2025 - Draft for public consultation

Image from ACCC "Merger process: Quick guide for businesses - What you need to know" 27 March 2025 - Draft for public consultation

Draft merger process guidelines

Released on 27 and 28 March 2025, the ACCC’s draft merger process guidelines (70 pages) and the 13-page business-facing summary guide aim to provide practical guidance on compliance and process.

The guidelines reaffirm the ACCC’s commitment to transparent and predictable timelines, but highlight that significant detail will be required even for smaller transactions.

They also flag the notification waiver process as a potentially simpler, quicker, path for transactions that meet the thresholds but raise no competition concerns. However, guidance on waiver criteria is still forthcoming.

Importantly, the guidelines confirm that a description of proposed transactions, together with key information within notifications, will be published promptly upon notification. There are very limited exceptions which are unlikely to be applicable for smaller and private market transactions.

Transitional arrangements

On 4 March 2025, the ACCC released its guidance on transitional arrangements. Key points include:

- voluntary notification available from 1 July 2025, enabling early use of the new regime

- compulsory notification (with mandatory approval) begins 1 January 2026

- informal merger review ends 31 December 2025. Engage with the ACCC early – ideally before October – to avoid delay

- merger authorisation applications will close from 30 June 2025, with pending applications lapsing at year-end

- Clearances granted under the old regime will be valid for 12 months

- Waiver applications may be made for certain transactions, with further guidance expected later in 2025

Key takeaways

- Begin reviewing transaction pipelines for deals that may trigger notification thresholds

- Plan for longer timelines and increased information requirements

- Draft conditions precedent to account for notification and approval timing

- Assess whether notification waivers may apply

- Engage early with advisers and the ACCC, particularly in Q3 and Q4 2025

The new regime represents a step-change in merger regulation in Australia. Legal teams should take early action to understand and integrate the new requirements and process into transaction planning and due diligence processes.

This article provides general commentary only. It is not legal advice. Before acting on the basis of any material contained in this article, seek professional advice.

Related Insights

Treasury consultation on Australia's proposed merger control thresholds

Important update: Transition to Australia's new mandatory merger control regime

The state of play: Current trends in M&A transactions

Legal Due Diligence: Debunking 7 Common Myths